Product Description

Tired of budgets that feel like punishment? The Budgeting Like a Pro: Complete eBook turns money management into a simple, flexible system you can actually live with. In clear, friendly language, this step-by-step guide helps you understand where your money goes, choose a budgeting method that fits your life, and build a plan that pays down debt, grows savings, and still leaves room for joy. If spreadsheets overwhelm you—or apps keep overcomplicating things—this eBook gives you a calm, practical path to financial control.

Practical Benefits

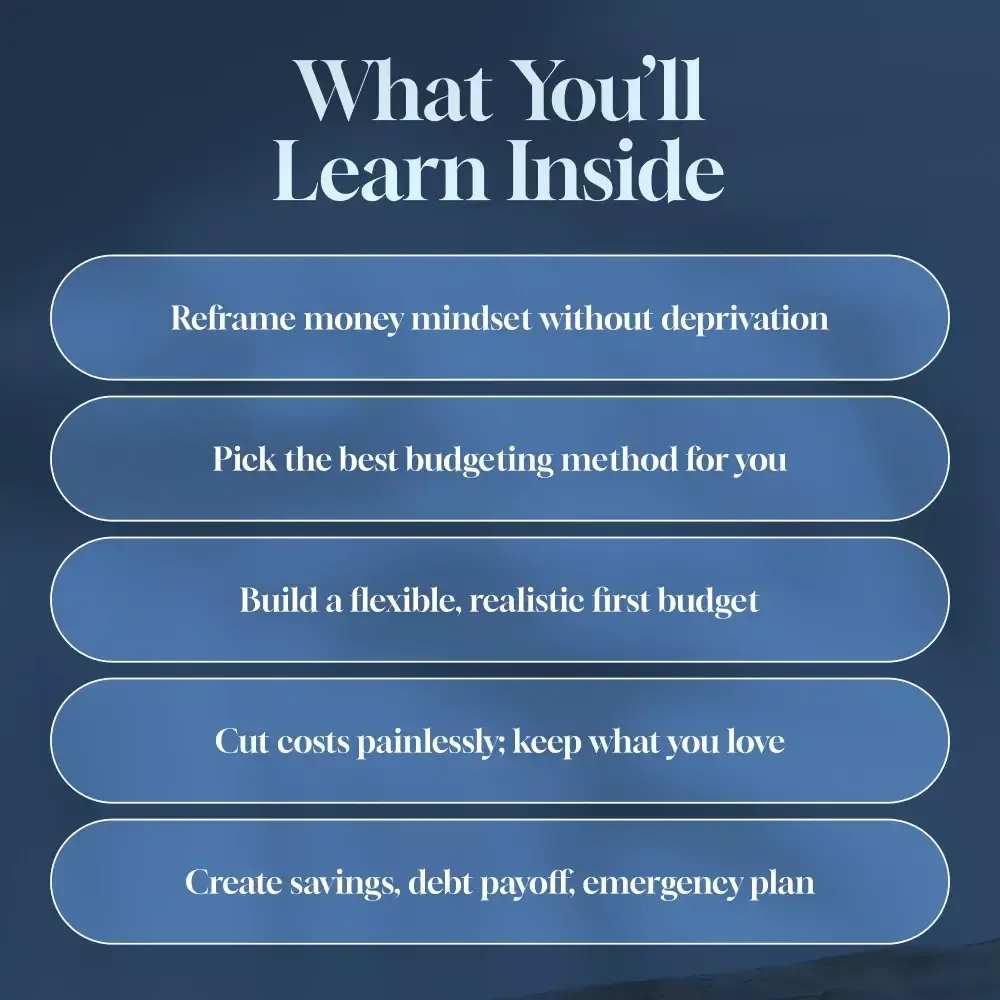

- Adopt a budget mindset that prioritizes freedom, not restriction.

- See your full money picture in minutes each month.

- Pick a method—Zero-Based Budgeting, 50/30/20, or Pay-Yourself-First—that truly fits you.

- Build a realistic plan for variable income and changing seasons.

- Cut costs painlessly while keeping what you love most.

- Follow a proven debt payoff strategy and grow savings faster.

- Prevent burnout with automation and quick check-ins.

Who Is This For?

- Beginners who want a clear, stress-free start to budgeting.

- Busy professionals or families seeking a flexible, realistic plan.

- Anyone who tried budgeting apps and wants a simpler, human approach.

What Makes It Different

Most money guides lecture; this one guides. You’ll get real-world examples—including Case Study: From Overdraft to Overflow in 90 Days and Case Study: How One Couple Saved $8K Without Giving Up Fun—plus actionable prompts like Prompt Example: Your Monthly Money Snapshot and Prompt Example: Build Your 6-Month Safety Net Plan. With side-by-side comparisons of Zero-Based Budgeting vs. 50/30/20 vs. Pay-Yourself-First, common-mistake call-outs, and step-by-step guidance for How to Budget on a Variable Income, you’ll build a plan that’s practical, sustainable, and genuinely motivating.

Make your money finally make sense. Download Budgeting Like a Pro: Complete eBook today and start building a flexible budget, faster debt payoff, and a savings plan you can stick with—no deprivation required.

How much does shipping cost?

We are glad to bring our customers great value and service. That’s why we provide fast shipping from our Fulfillment Center in California by UPS and USPS.

What countries are you delivering to?

As of now, we’re delivering to the United States only.

How can I track my parcel?

Once your parcel has left our Fulfillment Center, you will receive an email with a tracking number to monitor your parcel movements.

Can you ship my order to a business address?

Yes, you can write your business address in your order details if it’s more convenient to you.

Can you ship my order to a PO Box address?

Yes, you can select delivery to a PO Box if it’s more convenient to you.

Can you ship my order to APO or FPO military addresses?

Yes, we ship anywhere in the United States, and to all US territories and military APO/FPO addresses.

What happens to my parcel if it is delivered while I’m not there?

Depending on the destination and the package size, your parcel will be left in your mailbox or on your porch, or it may be left with a neighbour.

Can I cancel my order?

All orders can be canceled until they are shipped. If your order has been paid and you need to change or cancel it, please contact us within 12 hours of placing it.

Can I get a refund if something is wrong with my order?

Within 14 days of receiving the parcel, you can ask us for:

- A full refund if you don’t receive your order

- A full refund if your order does not arrive within the guaranteed time (1-3 business days not including 1 business day processing time)

- A full or partial refund if the item is not as described

Full refunds are not available under the following circumstances:

- Your order does not arrive due to factors within your control (e.g. providing the wrong shipping address)

- Your order does not arrive due to exceptional circumstances outside our control (e.g. not cleared by customs, delayed by a natural disaster).

All our products are backed with a 14-day money back guarantee. Just send us a message on the Contact Us page and we will refund the purchase price.

Can I return an item for an exchange instead of a refund?

Yes, you can! Kindly Contact Us form to discuss the details with us.

Can I return my purchase?

All our products are backed with a 14-day money back guarantee. Just contact us and we will refund the purchase price.

If you are not satisfied with your purchase, you can return it for a replacement or refund. No questions asked! You only should return it at your expense.

Please contact us first and we will guide you through the steps. We are always ready to give you the best solutions!

Please do not send your purchase back to us unless we authorize you to do so.

Are there any items I can’t return?

Hygiene and our customers’ safety is our top priority, which is why there are specific types of products that can’t be returned such as:

- Face and body products if opened, used, or have a broken protective seal

- Underwear if the hygiene seal is not intact or any labels have been broken

- Swimwear if the hygiene seal is not intact or any labels have been broken

- Pierced jewellery if the seal has been tampered with or is broken

If you're looking for real-world examples plus actionable prompts like 'Your Monthly Money Snapshot' or 'Build Your 6-Month Safety Net Plan', then this is definitely the eBook for you!

Automation and quick check-ins have made maintaining my budget much easier and prevented burnout – such a game-changer!

Budgeting has always been something I struggled with — it often felt restrictive and overwhelming rather than helpful. But this eBook completely changed my perspective. Instead of viewing budgeting as a set of strict limitations, I’ve come to see it as a tool for financial freedom — the ability to make confident choices with my money and plan for the future. The guide is written in a way that’s easy to understand, without complex financial jargon or intimidating concepts. Everything is explained in clear, everyday language, so you don’t need to be a finance expert to follow along. I appreciated how the examples were realistic and relatable, which made the whole process feel approachable rather than daunting. One thing I really liked is how it presents different budgeting methods rather than a one-size-fits-all approach. There’s Zero-Based Budgeting for those who like to account for every dollar, the 50/30/20 method for a balanced and straightforward system, and the Pay-Yourself-First strategy for people who want to make saving a top priority. Having these options gave me the freedom to experiment and choose the one that best fits my lifestyle. It also emphasizes that budgeting is personal. You’re encouraged to adjust the methods to suit your goals, not just follow rigid instructions. That sense of flexibility made a big difference for me. It felt less like I was being told what to do and more like I was being guided to take control of my own financial decisions. Another standout element was the focus on mindset. The eBook encourages you to see budgeting not as a chore, but as a way to create stability and peace of mind. For me, that shift in thinking was just as valuable as the practical tips. It reminded me that money management isn’t about perfection — it’s about progress and being intentional with your choices. Overall, this eBook isn’t just another generic budgeting guide. It gives you the tools, knowledge, and flexibility to create a financial plan that works for you, while also helping you feel more confident about your money. I’m genuinely glad I found it, and I can already see the positive changes in how I approach my finances.